Credit Score FAQs

Q:What is Credit Score?

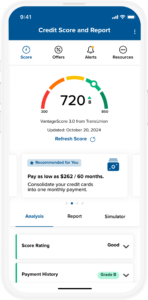

A: Credit Score is a free credit monitoring tool from Penn East FCU that helps you stay informed about your credit. You can check your latest score, view your full credit report, and understand the factors affecting your score. It also provides personalized loan offers that may help you save on interest.

Q: How Does Enrolling and Pulling My Credit Information Affect My Credit?

A.Great news! It doesn’t affect your credit profile or score in any way! Credit Score performs a soft inquiry when you enroll or refresh your credit profile, which means it does not impact your credit score—unlike a hard inquiry that happens when you apply for a loan.

Q: How does Credit Score monitor my credit?

A: Credit Score checks your credit report daily and alerts you via email if any significant changes occur, such as a new account opening, address or employment changes, reported delinquencies, or credit inquiries. This helps protect against identity theft.

Q: How is Credit Score different from other credit scoring tools?

A: Credit Score pulls data from TransUnion and uses VantageScore 3.0, a model developed by Equifax, Experian, and TransUnion to create a more consistent credit score across all three bureaus.

Q: Does Penn East FCU use Credit Score to make loan decisions?

A: No, Penn East FCU has its own lending criteria for loan approvals.

Q. If Penn East FCU doesn’t use Credit Score to make loan decisions, why offer it?

A: Credit Score helps you manage your credit so that when it’s time to borrow for a major purchase—like a home, car, or college expenses—you have a clear understanding of your credit health and can position yourself for the best possible interest rates. Additionally, the service provides real-time alerts to help you monitor changes to your credit report, allowing you to detect and respond to potential fraud attempts quickly.

Q: How does Credit Score keep my information secure?

A: We’ve partnered with SavvyMoney to bring you Credit Score, a secure tool that uses bank-level encryption to protect your data. Your personal information is never shared or sold.

Q: What if my Credit Score report has incorrect information?

A: If you find inaccuracies, you can dispute them directly with the credit bureaus. We also recommend obtaining your free credit report at www.annualcreditreport.com for further verification.

Q: Why do I see Penn East FCU product offers in Credit Score?

A: Credit Score provides offers based on your credit profile that may help you save money. These offers could include lower-rate loans or better financial products.

Q: Does Credit Score offer credit monitoring?

A: Yes, Credit Score tracks changes in your credit profile and sends alerts when significant updates occur.

Q: How do I update my email or personal information?

A: Your contact information updates automatically when you update it in Penn East FCU’s Mobile Banking. We encourage you to keep your information up to date.

Does your vehicle loan need a tune-up?

You might have heard of refinancing your home.

Did you know you can refinance your vehicle and credit cards as well? Bring your non-PEFCU loans to Penn East and we may be able to reduce your interest rate. Refinancing might allow you to lower your monthly payment, shorten your time to being debt-free, consolidate other high-interest debt, or all three! Bring it to Penn East and save.

Get the only credit card built for member-owners

A PEFCU credit card is a no-compromise mix of affordability and spending confidence

Most credit cards promise high rewards but come with equally high annual fees. Others aim to offer savings but fall short on convenience and accessibility. As a member-owned financial cooperative, Penn East provides a credit card with an affordable loan rate, plus the convenience and widespread acceptance of the world’s most trusted card network. When you spend, spend like an owner!